Seattle’s Condominium Conundrum

- An affordable housing crisis with for-sale products in King County can be addressed by encouraging development of more condominium units within the existing urban center zoning.

- The Puget Sound region is witnessing home prices rise again (at an accelerating pace) due to the lack of supply and increased consumer demand exercising a “buy then refi” strategy.

- Seattle remains the fastest-growing large city in the US over the past decade with more than 35,000 multi-family housing units delivered but less than 5% of this new supply was built for sale (as a result, the majority of Seattle residents are now renting).

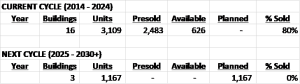

- In the current development cycle (2015-2025) 16 new condominium buildings are being delivered in Seattle with 3,109 units, and there are 626 unsold units (80% market absorption).

- Condominium developers face significant headwinds in delivering new for-sale housing given the trifecta of the high cost of land, entitlements, and construction, plus financing challenges with higher rates and stricter underwriting (zero new groundbreakings have occurred since 2020 and zero new supply for sale is expected in Seattle between 2025-2027 or potentially beyond).

- The COVID pandemic coupled with social challenges and political dysfunction has led to an in-city reset and then a residential renaissance, but the peak of projected condominium demand is expected to arrive at the same time that there will be no new for-sale units arriving on the market.

- In response to tepid market conditions during the COVID pandemic and mortgage underwriting requirements, condominium developers in Seattle have reduced asking prices by 20-30% from original presale projections, so inventory is being sold at well below replacement costs today.

- Statutes such as the Washington State Condominium Act, the Growth Management Act, and the Seattle Mandatory Housing Affordability Program have each contributed to an unintended cause and effect with higher home prices in the Puget Sound region.

- The new housing legislation House Bill 1110 is unlikely to deliver sufficient new housing stock to offset the lack of for-sale housing at more affordable price points.

- The commercial office vacancy will not give rise to residential conversions, but millions of square feet of available space at lower lease rates will attract a new generation of tenants, eventually replenishing daytime office workers in downtown Seattle and adding to residential demand.

- Leading project marketers representing 100% of the new condominium inventory agree on the impending dearth of new construction inventory and note an inflection point in the market.

- Savvy buyers that purchase existing inventory at reset pricing will likely enjoy equity growth similar to when new condominium values reset in 2010 and 2011 after the Great Recession.

- In order for developers to pencil new condominium towers, the resale and new construction home values will need to rise by 30-40% from current conditions, providing a clear runway of potential gains ahead for unit owners to enjoy the impending supply and demand imbalance.

- Pragmatic government policies could better align the interests of developers and municipalities to support the construction of more housing to meet the demand for attainable ownership.

Market pundits agree condominiums are an important, if not a critical, step on the homeownership ladder, but this product segment is significantly underserved in the Puget Sound region. Multi-family density, convenient urban locales, single-level living, design efficiency, lock-and-leave lifestyle, and relative affordability all bode well for consumers compared to townhomes, cottages, or single-family homes as prices continue to rise everywhere. Consumers can afford to live in less space, but they can’t afford to pay more than they can afford.

The City of Seattle enables multi-family development only in limited areas; the majority of land in the City of Seattle is zoned for single-family use. Where multi-family is permitted, developers have overwhelmingly preferred to build apartments for rent, instead of condominiums for sale. Not surprisingly, the majority of Seattleites are now renting. Condominium developers face high construction costs, elevated interest rates, and onerous legal risks while mandatory entitlement fees, zoning, and growth management boundaries limit their opportunity to build more homes. Exacerbating the issue, would-be sellers are reluctant to list for sale and release a sub-4% mortgage rate as buying an alternative home might dramatically increase the cost of ownership. Only a higher volume of attainably priced condominium units would address a housing affordability crisis that persists. That reality remains elusive until municipal and state-level policymakers balance the risks and rewards for developers.

MOVING ON UP

After a sugar high of historically low mortgage interest rates in 2020 and 2021 (and consumer desire to live and work differently during the COVID era), the US set record housing sales values and volumes. Then to curb inflation, the Fed delivered eleven consecutive hikes in the central bank rate in 2022 and 2023, creating a whiplash effect with many would-be buyers practicing “wait and see.” Home prices spiked, stalled, corrected, and then rebounded all within 48 months. The irony is that housing constitutes about one-third of the Consumer Price Index, so while the US housing market closed out 2023 with 30-year low sales volumes, home prices are again climbing at an accelerating pace.

According to the latest S&P/Case-Shiller Home Price Index, all 20 cities in the US posted year-over-year gains, and many, including the Seattle Metro Area, set new benchmark records. Buyers and sellers recalibrated. Home values already factor in the higher mortgage rates, and a bullish stock market is adding liquidity (consider that more than $1.5 trillion in equity gains were realized by tech titans in 2023 alone). The NWMLS data as of March 2024 reveals the median single-family home price in King County was $945,500, 13% higher than a year ago. The same trend is present with condominiums in the City of Seattle, where the greatest volume of high-density zoning exists (albeit at lower price points). Here the median sales price was $587,500 for a 9.8% year-over-year increase in March 2024. Even the center city condominium market, which was hit the hardest during the pandemic, is expanding again with the average resale sales price rising 4.4% as of Q1-2024 year-over-year. So, the most affordable product type doesn’t feel that attainable, and it’s getting more expensive as inventory is being absorbed from the bottom up.

RENTAL RULES

A supply and demand imbalance would call for more condominium development, especially large towers where 500 or more units are delivered in a single phase. It’s true that downtown Seattle has been America’s fastest-growing large city over the past decade. Dubbed “Crane City, USA”, the Emerald City spawned 35,000 new multi-family units within walking distance of each other since 2010. This development boom was encouraged by former Seattle Mayor, Greg Nickels’ “Center City Plan” adopted in 2006. This policy allowed for much taller, slenderer buildings with tower spacing and required developer contributions toward affordable housing funds. Seattle City Council furthered that initiative in 2019 by adopting the Mandatory Affordability Housing (MHA) Program, which charges fees to developers for density (adding costs to the consumer).

According to the Downtown Seattle Association, the pace of multifamily development is still booming and is now second only to Denver in the US. However, building permits in Seattle are still less than the peak of 2016 (ten years after major densification policies were first implemented). The conundrum is that an estimated 95% of this new product was purpose-built for rent and not for sale. To be sure, rental demand has been high, as new residents are arriving daily for open jobs, especially in the high-tech industry (logically, most would seek to rent before buying anyway).

Millennial tech workers are notoriously transient and most of their wealth is tied to restricted stock units. Their common thought is that tech stock share prices will rise quicker than real estate values. The imposed Washington State Capital Gains Tax on equities made selling stock 7% more expensive as of January 1, 2022 (this policy may be repealed in the November 2024 election results). Still, the demand side may be less of an issue versus significant supply-side headwinds. Developers are simply reluctant to risk building condominiums given exposure to market cycles, burdensome capital stacks, and the potential of litigation.

A rental building rides the waves in a variable market, distributing the risk of development over many years. That developer can refinance or monetize the investment in a single exit transaction, rather than trying to time the market perfectly years in advance across hundreds of individual transactions. A condominium developer must time the market well and hope that the market remains ascending long enough to ensure closings, providing sufficient profits to be earned and then retained through the warranty period. Unfortunately, few condominium developers in recent years have navigated this labyrinth successfully.

DEVELOPERS BEWARE

The Washington State Condominium Act was enacted on July 1, 1990, which includes many consumer protections that are averse to developers. Buyers are limited to just 5% earnest money deposit on a presale condominium (when a developer is offering units for sale sometimes years before the building is delivered). Even though the buyer had risk money available in the deal, it is not released to the developer until after all the consumer risks pre-closing are addressed. So, the developer must generate 100% of the equity and construction debt to fund the building (on top of buying land and paying millions in architectural and entitlement work). That’s costly for underwriting and this policy works against the required investment returns for developers to pencil the project. Furthermore, the developer must take all the risks during presales and initial closings. If a presale buyer doesn’t wish to close on the condominium that was placed under contract to build, they aren’t required to, and the buyer forfeits only their limited earnest money deposit. Realistically, a buyer has only 5% at risk and the developer bears the balance with 100% of the capital requirement. Then with market cycle dynamics and public records, if the perceived value of a unit drops by 8-10% prior to closing, the developer and buyer are likely to explore revising the sales price or risk losing the sale. If the market values do rise, the savvy presale buyer enjoys all the appreciation during the construction schedule, sharing none of it with the developer. This policy is unique to Washington State.

In sophisticated and robust condominium markets such as Vancouver, BC, or Miami, Florida, presale buyers have a stepped-up deposit structure in the development, upwards of 20-30%, which contributes to the construction costs in real time. Those developers also command specific performance to close upon occupancy with other recourse should the buyer fail to do so. When presales do close successfully in Washington State, the developer is bound to certain warranty provisions for several years. So, the actual profitability remains subject to construction defect liabilities and likely legal costs and distractions associated with such a success.

Across the board, the developer remains subject to greater risks and more arduous debt and equity underwriting to deliver a condominium versus an apartment building. Now consider that apartment rents have effectively doubled since 2010, and it is understandable why merchant building of apartments is performing better for investors. That also means thousands of future condominium buyers may be incubating in pricey apartment towers but condominiums as a product line are underrepresented in the skyline to serve them affordably.

MARKING TO MARKET

Another demand-side challenge is mortgage underwriting. Here again, consumer protection policies create unintended headwinds to development to benefit the ultimate mortgage holder. Most mortgage originators observe loan conformance requirements dictated by Fannie Mae. To sell these mortgages to Fannie Mae, the building must have supportive market values and sales momentum. Developers must also certify that the majority of units are sold to consumers who intend to live in the units. The concern is that a building with a majority of investors would not be well maintained and then be subject to higher turnover and of lesser value.

Recall that it was a lack of homeowner equity and bank-owned real estate that contributed to the credit crunch and mortgage underwriting reforms, so there are prudent policies to not repeat this scenario again. There is no secondary market for mortgages in a building with too much commercial interest or too many investor sales with renters (or short-term rentals such as Airbnb). Only a majority of qualified presales to owner-residents will suffice, so developers will have to do what it takes to identify these buyers and reach the owner-occupied sales goals. If there are insufficient presales upon occupancy to close these mortgages, only cash closings or portfolio loans from banks will be able to do so. Alternative lending for non-warrantable mortgage products usually requires higher down payments, higher FICO scores, and even higher mortgage interest rates. All of these scenarios work against the developer’s agenda of bringing attainability to their product.

Oftentimes, developers need to make up for the difference by lowering their sales prices, offering buyer bonuses, or buying down the mortgage rate. Marking to market has occurred with all the most recent condominium developments, ranging from 20-30% below prior presale prices. Unfortunately, this eroded the profitability of these investments, so these developers are less likely to repeat the experience.

SHAKE AND BAKE

Both developer and consumer confidences were shaken during the COVID pandemic, as the in-city submarket experienced global media attention for social challenges and political dysfunction. Downtown Seattle witnessed a net loss of 5,000 residents by the end of 2020. This quickly recovered in 2021 and continues to grow today with an estimated 106,000 residents. A residential renaissance is taking hold, especially with a new, more pragmatic Seattle City Council in place for 2024. Large employers, like Amazon, are driving return-to-work policies.

Many US cities are considering the conversion of vacant commercial office space to residential use, but practically speaking, this office space format (deep cores, lack of opening windows, and locations) won’t evolve easily or cost-effectively to residential use. Unless there are major incentives in place for developers to take this risk, such as a new government policy or tax break, it just doesn’t pencil to explore a change of use. A greater benefit to this in-city ecosystem is vacant office buildings that will eventually fill, and this supply lays down a long runway for future job growth and housing demand in the city. That will take time and sharper lease rates will add to the region’s competitiveness for recruiting and retention. This package would be made even more compelling if nearby housing was more affordable.

An office reboot may not be easy on landlords or lenders, but it will ultimately bode well for condominium demand. It’s better to have the vacant office to grow into than to wait for the next cycle of development, which could be a decade or more away. This demand may arrive just in time for zero supply because new condominiums are not breaking ground.

IN YOUR BACKYARD

One alternative and attainable housing solution may come from the state legislated House Bill 1110, which by July 2025 requires Washington municipalities to permit more in-fill development of residential units. Some neighborhoods near rapid transit stations are (to be) permitted for up to six units on the property. This is a fundamental change in policy, which may become a paradigm shift in what neighborhoods look like, not to mention impacts to traffic, transportation, and personal security as populations increase. Interestingly, this new policy to address the “missing middle” housing demand is occurring exactly 40 years after Washington State adopted its Condominium Act and Growth Management Act, and it’s nearly 20 years after the Center City Plan was implemented. These timelines illustrate just how slow legislators and policymakers respond to consumer trends with planning that promotes new development. The zoning change and resulting consumer benefits can take a decade or more to manifest. The one commodity that cities own is their air rights and density, so upzoning and reducing costs for developers may bring more results. Unfortunately, the MHA Program is cited by many developers as a reason they cannot afford to build right now.

RINSE AND REPEAT

To be sure, housing markets and development cycles are consistently rolling in 10-year patterns, and developer and lender confidence spikes and corrects, accordingly. The most recent for-sale cycle kicked off in 2015 with a collection of newcomer condominium buildings in downtown Seattle. This followed a dearth of supply that lasted four years after the global credit crunch and impending Great Recession in 2008/09 (the last major condominium tower financed was Escala in mid-2007 which delivered in 2010). Given no groundbreakings occurred in 2008 or thereafter until 2012 (when the Insignia condominium tower(s) commenced), there were zero new condominium deliveries from 2011 until 2015, when the south tower of Insignia was finally delivered. The challenge with high-rises is demand can rise much quicker than supply. It can take 4-5 years for a new high-rise condominium tower to work through entitlements, excavation, and vertical construction; and then final sell-through can extend for several years after completion depending on market conditions. In the current cycle that’s closing out, there were more than two dozen new condominium developments formally proposed and activated (and even more rumored). However, two projects were cancelled outright, and five reverted to apartment use for rent after deciding to abort these offerings for sale. It’s noteworthy that only about two-thirds of the proposed condominium developments in Seattle were actually consummated, and it’s a reminder that the market is historically over-announced vs. overbuilt.

Ultimately, more than 80% of the newly developed condominium units in the current cycle have sold (or remain pending), with 626 units available in active offerings, including 18 delivered buildings and one still under construction for occupancy in late 2024. Another three condominium developments remain proposed, comprising another 1,167 units. However, these new groundbreakings have not been scheduled, and it could still be several years before these developers receive construction financing, which may delay the projects. It is also just as possible that one-third of these developments either develop as apartments or don’t come to market at all, historically speaking.

Looking at the Seattle new condominium market holistically illustrates a repeating pattern of several years of no new unit deliveries followed by a gold rush of supply at substantially higher prices (and typically novel designs). These same conditions occurred in the early 2000s with anemic inventory followed by a surge of presales. It’s apparent that dearth conditions experienced from 2011 through 2014 may well prove to be the case in a broadening vacancy of new construction units for sale starting in 2025 and extended into 2017 (or beyond unless the planned developments prepare to break ground in the next year).

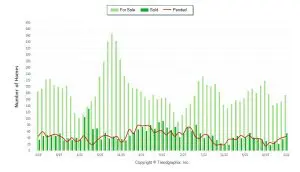

New condominium inventory joins a market of existing resale product, as well as a substantial apartment stock with robust rental development alternatives in the pipeline (especially when new apartment buildings are in their initial lease up efforts and offering substantial concessions). A study of the resale supply over the last five years shows a simultaneous spike of supply in 2020 just as the new inventory was delivering and attempting to hold the prior presale values.

There was a significant exodus from urban living during the onset of the COVID pandemic, meaning not only did departing condominium owners opt to sell their homes, but so did investors who were digesting vacancies, and they also faced the reality of home value corrections. The prospect of greater competition from new apartment buildings coming online coupled with a fresh crop of inspired condominiums offering newer features meant that investment-grade products may soon face value headwinds. Some of these investors purchased during the depths of the last market correction, so they had plenty of equity to harvest despite the values being muted for the time being. Fortunately, by the first half of 2021, there was a significant return to the urban center, as the first round of 12-month leaseholds burned off, consumer confidence was being restored, and downtown Seattle’s residential population was replenished.

As a current snapshot of new and resale condominium activity in downtown Seattle (NWMLS #701), the general trends are for improving supply and demand year-to-date with pending sales 7.5% higher and closed sales are 5.4% greater than the same period a year ago. It’s important to note that all the new construction inventory is posted to the NWMLS (for instance just 41 of the 626 available new condominiums are reflected in the NWMLS data).

MARKET MAKERS

During a recent Market Maker Event hosted by Realogics Sotheby’s International Realty (RSIR) on April 3, 2024, a collection of project marketing firms assembled for a panel discussion surrounding the Condominium Conundrum. This was the first time that 100% of the new development representatives and leading mortgage lenders were collaborating on the state of the in-city condominium market, and their collective viewpoint represents 100% of the available inventory for sale with unparalleled experience retrospectively.

This think tank was asked a series of ten questions (A-J) concerning their view of the current and projected condominium market conditions. Answers were assessed a value score as outlined below and summarized thereafter with anecdotal contributions during the panel discussion:

- A) How would you generally describe the projected in-city condominium market in the year 2024?

- Terrible – it is very challenging with declining buyer demand and rising supply as values will continue to plummet.

- Soft – market headwinds persist with sluggish demand and a glut of unsold inventory to work through with likely price corrections.

- Stable – there is a good balance of supply and demand, so sales volumes and values are generally sustained.

- Improving – sellers are gaining more strength and both buyer demand and values are rising once again.

- Vibrant – there is fast-rising buyer demand and plummeting inventory as values skyrocket.

ANSWER SCORE 3.00 – The respondents view the market as “Stable” and noted the developers have marked to market in values, consumer confidence is improving, and sales volumes are increasing, so a clear inflection point has occurred.

- B) How would you generally describe the projected mortgage interest rate environments in 2024?

- Devastating – the high mortgage rates and threat of rate increases ahead have sidelined would-be buyers to rent instead.

- Pessimistic – the stalling rate drops once hoped for are weakening demand further and giving buyers cause for pause.

- Neutral – the status quo of mortgage rates and varied opinions on their trajectory have caused a “wait and see” marketplace.

- Optimistic – buyers are increasingly confident the Fed will continue to drop rates, and more buyers are adopting “buy then refi” strategies.

- Exceptional – the dropping mortgage rates and belief that further drops ahead are spiking buyer demand significantly.

ANSWER SCORE 3.50– The respondents view the market as being “Neutral” to “Optimistic” noting that the Fed has indicated that rate cuts are planned, but that recent jobs reports have come in higher than expected, so the timing of the rate cuts may be deferred to the end of 2024 (but buyers understand they can buy then refinance).

- C) How would you generally describe the projected new construction condominium values in 2024?

- Falling Knife – prices are dropping and would-be buyers are waiting for significant corrections by year-end.

- Decreasing – downward pricing pressure is more evident as sellers are becoming firmer amidst supply and demand imbalance.

- Stabilizing – prices have already been corrected in recent years and buyer activity is returning to support new prices.

- Increasing – upward pressure is more evident as sellers are becoming firmer amidst supply and demand imbalance.

- Skyrocketing – prices are rising quickly and sellers are planning for significant increases by year-end.

ANSWER SCORE 2.83 – The respondents noted the values as being between “Decreasing” and “Stabilizing” as developers remain motivated to move inventory with some room to negotiate, but the overall market has already corrected by 20-30% depending on the building in the past four years since occupancies began, and the majority of inventory has been sold with greater value stability in place.

- D) How would you generally describe the projected new construction condominium pipeline in Seattle?

- Anemic – there are effectively no new groundbreakings planned and it could be many years before new inventory is delivered.

- Decelerated – there are fewer new projects planned and the general trends will be reduced choices ahead.

- Status-quo – there is a consistent number of new projects in the pipeline in the years ahead with a consistent drumbeat of supply.

- Accelerated – there is an increasing number of new projects planned and the general trend will be for increased choices ahead.

- Excessive – there is a significant glut of new groundbreakings likely to happen and the market will soon be flooded with inventory.

ANSWER SCORE 1.67 – The respondents noted the pipeline as being “Decelerated” and heading towards “Anemic” given that no new groundbreakings have occurred since 2020 and there are zero new developments expected to move forward soon, resulting in a clear dearth of supply for three years or more.

- E) How would you generally describe the projected new construction condominium pipeline in Bellevue?

- Anemic – there are effectively no new groundbreakings planned and it could be many years before new inventory is delivered.

- Decelerated – there are a fewer new projects planned and the general trends will be reduced choices ahead.

- Status-quo – there is a consistent number of new projects in the pipeline in the years ahead with a consistent drumbeat of supply.

- Accelerated – there is an increasing number of new projects planned and the general trend will be for increased choices ahead.

- Excessive – there is a significant glut of new groundbreakings likely to happen and the market will soon be flooded with inventory.

ANSWER SCORE 2.67 – The respondents noted Bellevue as being more likely than Seattle for new inventory rating the market as “Status-quo” but “Decelerating” with no immediate groundbreakings but greater confidence in new supply based upon the developers approaching and market fundamentals.

- F) In light of COVID-era realities, how would you generally describe the in-city condominium buyer demand projections over the next five years?

- Lights Out – the overall trend ahead will be to live in exurban locations, in smaller communities, with work-from-home lifestyles and infrequent visits to the city.

- Substantially Declining – the livability of the city will continue to struggle amidst social issues and commercial headwinds and become increasingly less desirable.

- Status-quo – there will be consistent demand experienced over the next few years without any noticeable increase or decrease in population.

- Substantially Improving – a residential renaissance is shaping up, mortgage rates will drop, renters will become buyers, and downsizers will seek single-level living.

- Meteoric – the city center is quickly rebooting, offices will repopulate, amenities will flourish, and demographics will stream back to urban living and ownership.

ANSWER SCORE 2.67 – The respondents are generally “Status-quo” with demand trends, noting that demographics are supportive, and they share the belief that mortgage rates will sharpen, allowing more renters to become owners, but some headwinds are still present given the unknown outcome of the commercial real estate market and municipal policies.

- G) In light of recent market realities, how would you generally describe the current developer perspective looking out over the next five years?

- Withdrawn – developers are not moving forward at all given market conditions (unsupportive values, higher costs, litigation concerns, etc.)

- Bearish – most developers that have projects in the pipeline continue to pause commencement or may be considering a rental exit instead.

- Wait and See – it’s too early to tell how supply and demand will balance in the coming years so for now developers are holding and hoping for alignment.

- Bullish – most developers that have projects in the pipeline are continuing to move forward with their agenda in anticipation of market improvements.

- Exuberant – the obvious spike in buyer demand and lack of inventory requires aggressive construction activity immediately attracting even more developers.

ANSWER SCORE 2.0 – The respondents are pretty clear that developers are “Bearish” given the current market values do not support new construction, and the cost of construction and lending is further challenging groundbreakings at this time.

- H) What statement best reflects your opinion of the importance of condominium development as a consumer product for the Seattle/Bellevue metro area?

- Unnecessary – there are plenty of existing units for sale and for rent and the consumer demand prefers other product types like single-family homes and townhomes.

- Unsure – consumers will evolve to find housing solutions that suit their needs and the impact of House Bill 1110 may forever change the landscape for new development.

- Status-quo – condominiums will continue to serve the buyer demand, as it has historically, without much change ahead.

- Important – the majority of renters in the region will increasingly seek ownership options and condominiums are the most affordable product type.

- Critical – the only way that King County will reach its housing goals is to encourage more attainable ownership in higher volume.

ANSWER SCORE 3.67 – The respondents are leaning towards a greater need and an “Important” rating for condominiums in the marketplace given the lack of attainable housing and noted dearth of supply in the future.

- I) What statement best reflects your opinion of the challenge that condominium developers face when building?

- Nearly Impossible – there are simply too many liabilities, too many fees and entitlements, and no economic incentive to build condominiums profitably so supply will suffer.

- Disadvantaged – developers are facing headwinds with the fundamentals to build more condominiums and supply will decrease ahead.

- Balanced Opportunity – developers and policymakers are aligned with the risks and rewards across the board to sustain new supply ahead.

- Advantaged – developers have the upper hand with the fundamentals to build more condominiums and supply will increase ahead.

- Quick and Easy – developers have boundless opportunity to build profitably and enjoy great advantages to deliver plentiful housing units.

ANSWER SCORE 1.83 – The respondents note developers are clearly “Disadvantaged” and it may even be “Nearly Impossible” for new project groundbreakings in the coming years, hence the dearth of new supply is a confident prediction and allows the current supply to be absorbed in the interim, which is firming up pricing.

What statement best reflects your opinion of what in-city consumers will be facing with new and resale condominiums in 2025?

- Market Correction – mortgage rates will remain high, buyers will pull back, demand will dwindle, and resale supply will increase with prices falling sharply.

- Weakening – buyer demand will decrease and resale and new construction inventory will linger on the market with prices trending downward.

- Balanced Market – supply and demand will be in harmony with about six months of inventory, stable pricing, and ample selection as the market normalizes.

- Tightening – buyer demand will increase, encouraging more resale listings and improved absorption of standing new construction inventory and rising values.

- Pent Up Demand – mortgage rates will drop significantly; renters will increasingly seek to buy but there will be limited inventory given the dearth of new supply causing multiple offers.

ANSWER SCORE 3.83 – The respondents note the inflection point in the market citing the “Balanced Market” is further “Tightening” as supply and demand tips further to sellers with values bottomed out and with a similar rebooting of the next development cycle as new and resale prices are forced to rise until the new developments pencil in the years ahead.

DEVELOPER DEJA-VU

Few could deny that buying a new condominium for 20-30% below replacement costs wouldn’t be a once-in-a-cycle moment. That’s true in any market. Buyers could take advantage of market pressures while enjoying the residential renaissance and lifestyle investment you can live in. If this sounds familiar, that’s because history is repeating itself. In the aftermath of the Great Recession, brand new condominiums were offered at just $450-500 per sq. ft. from 2010-2013. Today, these homes are being sold at twice that price, notwithstanding the most recent market correction now complete. This happened in part because there was a new supply vacancy for four years. During that time, the market (and developers) caught up. Realogics Sotheby’s International Realty had a front-row seat for this evolutionary market reset representing the last new construction inventory in that cycle and a decade later, the same scenario plays out yet again. The difference from a decade ago is that there are 30,000+ new luxury rental occupants living in downtown Seattle, paying significant rents, and many may be eyeing a purchase, especially as mortgage interest rates are projected to decrease. On a unit basis, if just 5% of that rental audience decided to pivot to buy a comparable unit in the next few years, the existing new construction supply would be sold out twice over.

SALES SCHADENFREUDE

The German idiom “schadenfreude” is the experience of taking pleasure (or opportunity) in response to another’s misfortune. In real estate, it’s the nature of negotiation to play off development cycles and enjoy market pendulums, sometimes swinging in favor of buyers and other times for sellers. With high-rise developments, a protracted construction schedule and lofty perch offer a lengthy oscillating pendulum swing (years of potential value growth for buyers during the dearth of supply). In theory, a balanced market is the most sustainable one, ensuring supply and demand are evenly matched. That never seems to happen with high-rise development because the protracted construction schedules are just too long. A savvy and supportive government could offer both, competing against other cities instead of creating internal pressures in the Puget Sound region. As the resale condominium market bounces off the floor, and new construction supply is burned off in the coming years, prices should again grow 20-30% collectively, and only then will the new supply come. Developers simply won’t pay a public sacrifice to play their role in public service for housing. It’s ironic that government intervention and consumer protection policies work so well for buyers that they deter condominium developers, but that’s the reality. This only brings the next round of “policy whac-a-mole” to solve new problems. Still, until the returns offset the risks associated with building a new condominium, developers (and their lenders) are more inclined to build for rent. That becomes a self-fulfilling prophecy about what kind of housing lies ahead in the new normal. COVID taught lessons on how quickly the market can shift in a year or two, be that the cause and effect of a virus or the government playing a role in free enterprise. Yet with major housing policy changes taking root every few decades or so, this impending condominium dearth may only benefit the future owners of 626 unsold units that ride the pendulum swing in a city of 106,000 residents already living within the urban core of downtown Seattle.